After a strong rally in June, the market showed further positive performance for the month of July that led broad market indices to all time high. Lower energy prices over the month were helpful, as was the government’s reversal of a windfall tax on local crude oil sales and fuel exports. The S&P Global India Services PMI unexpectedly rose to 62.3 pointing to the highest expansion in over 13 years. The Q4 earnings have also been encouraging indicating continued demand traction.

Sameeksha PMS (Portfolio Management Service = Segregated Accounts) gained 8.3% (net of all fees and expenses), and carved a strong outperformance (alpha) when compared to the benchmark BSE500TRI which gained 3.9%.

Sameeksha AIF (Alternative Investment Fund = “Hedge Fund”) gained 8.3% (post expenses pre tax), and carved a strong outperformance (alpha) when compared to the benchmark BSE500TRI which gained 3.9%.

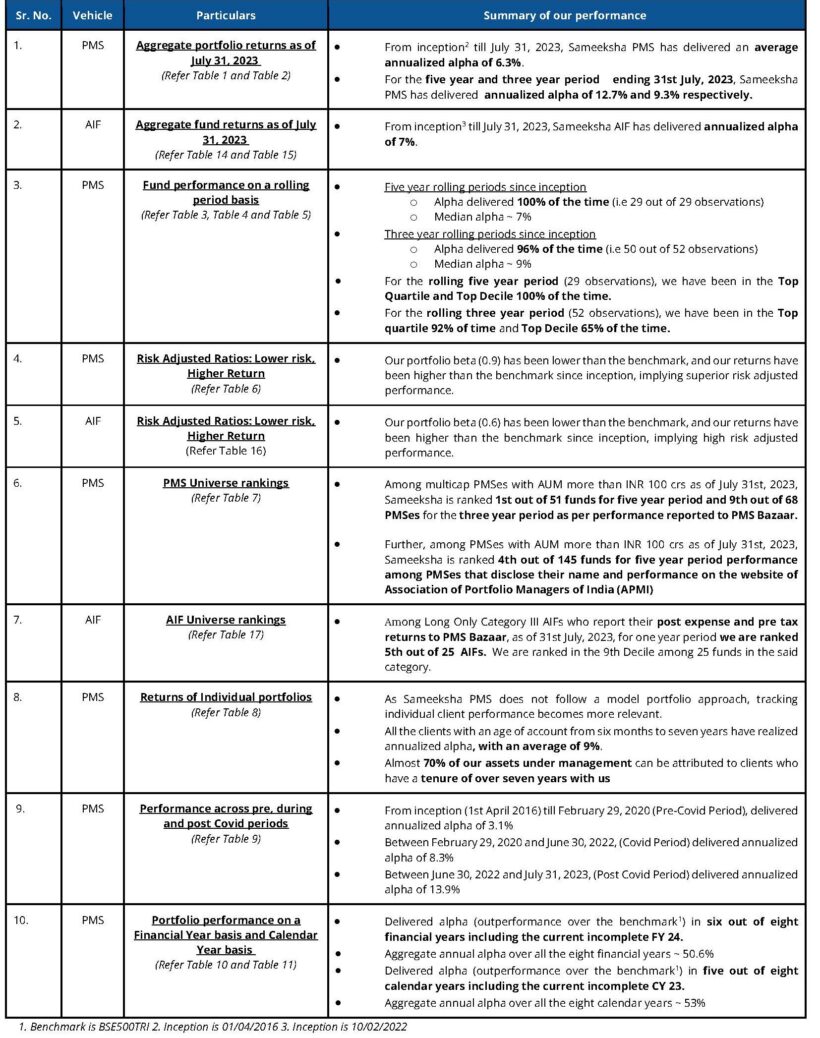

It is worth reviewing the key aspects of the performance of our PMS and AIF as summarized below:

PMS Performance and other details

Three important things must always be kept in mind when looking at performance data. First, for funds such as ours that do not follow model portfolio strategy, the performance of individual clients for different duration is important to look at. Second, some PMSes may be charging fees outside the PMS and hence after fees, performance data may not be comparable to ours. Third, it is important to look at not only portfolio returns but also risk adjusted ratios. We provide data to address all three points later in this note.

Aggregate Portfolio Returns over various time periods

Sameeksha PMS has delivered a substantial aggregate annual alpha of 50.6% over BSE500 TRI over the 8 financial years (including the current incomplete financial year) implying an average alpha of 6.3% since inception (Table 1).

|

Table 1: Key data on alpha generation over eight2 financial years since inception1 |

|||

|

Key Indices |

Aggregate alpha generated % |

Average alpha generated% |

% times alpha generated over 8 FYs |

|

BSE500 TRI |

50.6 |

6.3 |

75% |

1. Inception Date 1/4/2016 2.. Current financial year upto 31st July 2023

It is important to note that we have maintained relatively higher levels of cash (13.2% on average over the entire period from inception) from time to time over the duration of managing the portfolio. Notwithstanding the same, from inception as well as over five and three years respectively, we have generated returns of 21.9%, 26.2% and 34.5% beating the benchmark BSE500 TRI returns of 15.7%, 13.5% and 25.2% respectively after fees and expenses. We have delivered strong returns relative to benchmark across various key time periods. (Table 2).

|

Table 2: Portfolio % performance since inception |

|||

|

Period |

Portfolio % 1 2 (A) |

S&P BSE 500 TRI % (B) |

Alpha vs BSE500 TRI % (A-B) |

|

Since Inception 3 4 |

21.9 |

15.7 |

6.2 |

|

5 Years |

26.2 |

13.5 |

12.7 |

|

3 Years |

34.5 |

25.2 |

9.3 |

|

2 Years |

15.9 |

13.0 |

2.9 |

|

1 Year |

35.5 |

17.4 |

18.1 |

|

6 Months |

25.1 |

14.8 |

10.3 |

|

3 Months |

20.6 |

12.5 |

8.1 |

|

1 Month |

8.3 |

3.9 |

4.4 |

1. Post Fees and Expenses, 2. Aggregate Portfolio , 3. Annualized For more than one year 4. From Inception (1/4/2016) till 31st July 2023

Agreegate Portfolio Performance And Ranking In a Rolling Period basis

Rolling returns are a more useful indicator of consistency in performance versus single period returns. For the rolling three year period applicable to our entire operating history, Sameeksha PMS has delivered aggregate annualized alpha 96% of the times (50 out of 52 observations) ranging from 0.4% to 23%. For the rolling five year period applicable, Sameeksha PMS has delivered aggregate annualized alpha 100% of the time (29 out of 29 observations) ranging from 5% to 13% (Table 3).

|

Table 3: Number of times alpha1 generated over rolling five and three year periods |

||

|

Particulars |

Rolling Five Year periods |

Rolling Three Year periods |

|

Number of observations |

29 |

52 |

|

Number of times alpha generated |

29 |

50 |

|

% times alpha generated |

100% |

96% |

|

Median annualized alpha |

7% |

9% |

|

Maximum annualized alpha |

13% |

23% |

|

Minimum annualized alpha |

5% |

0.4% |

1. For this calculation, alpha is calculated over BSE500 TRI

For the rolling three year period applicable to our entire operating history, we have been ranked among the multicap universe in the Top Decile 65% of the time (34 out of 52 observations) and in the Top Quartile 92% of the time (48 out of 52 observations). For the remaining 8% observations, we were ranked in the Second Quartile (Tables 4 and 5). For the rolling five year period applicable for our entire operating history, we have been ranked among the multicap universe in the Top Decile 100% of the time (29 out of 29 observations).

|

Table 4: Decile distribution of our rank within the Multicap PMS universe on a rolling basis since April 2019 |

|||

|

Particulars |

One Year |

Three Years |

Five Years |

|

Number of Observations |

52 |

52 |

29 |

|

Top Decile 1 |

40% |

65% |

100% |

|

9th Decile 2 |

23% |

23% |

0% |

|

8th Decile |

13% |

8% |

0% |

|

7th Decile |

2% |

2% |

0% |

|

6th Decile |

8% |

2% |

0% |

|

5th Decile |

4% |

0% |

0% |

|

4th Decile |

6% |

0% |

0% |

|

3rd Decile |

4% |

0% |

0% |

|

Total |

100% |

100% |

100% |

1. Top Decile = in top 10%, outperformed 90% of the funds 2.. 9th Decile = in top 20%, outperformed 80% of the funds

|

Table 5: Quartile distribution of our rank within the Multicap PMS universe on a rolling basis since April 2019 |

|||

|

Particulars |

One Year |

Three Years |

Five Years |

|

No. of Observations |

52 |

52 |

29 |

|

Top Quartile 1 |

71% |

92% |

100% |

|

2nd Quartile 2 |

21% |

8% |

0% |

|

3rd Quartile |

4% |

0% |

0% |

|

4th Quartile |

4% |

0% |

0% |

|

Total |

100% |

100% |

100% |

1. Top Quartile = in the top 25%, i.e. outperformed 75% of the funds 2. 2nd Quartile = in the top 50% i.e. outperformed 50% of the funds

Risk Adjusted Ratios: Not all returns are the same, Higher Returns at lower Risk

When compared on a risk-adjusted basis, our PMS shows an even stronger performance with a risk-adjusted alpha generation of 6.2% over the broader market benchmark since its inception. While our portfolio beta has been materially lower than our benchmark, our returns have been higher than the benchmark since inception, implying superior strong risk adjusted returns.

Furthermore, other risk-adjusted returns – Sharpe ratio and Treynor ratio, are also significantly higher than the benchmark (Table 6).

|

Table 6: Risk-Adjusted Performance Ratios 1 |

||

|

Performance Indicators |

V/s BSE 500 |

|

|

Portfolio |

Index |

|

|

Jensen’s Alpha (x) |

6.4 |

0 |

|

Treynor Ratio (x) |

23.0 |

16.2 |

|

Sharpe Ratio (x) |

1.2 |

0.9 |

|

CAPM Beta(x) |

0.9 |

1 |

|

R – Squared (%) |

75 |

100 |

1. From Inception (1/4/2016) till 31st July, 2023

Performance within the PMS Universe

We continue to maintain our top rankings both within the multicap PMS universe as well as the entire PMS universe for key periods of three and five years. The multicap PMS universe rankings are more relevant to us since we follow the multicap strategy.

In the interest of a fair comparison, we present our rankings among those multicap PMSes with AUM more than INR 100 crs. Within this universe, we are 1st out of 51 PMSes for the five year period and 9th out of 68 PMSes for three year period, highlighting our superior performance over the long term periods (Table 7). Among the multicap universe (considering all AUM), we are consistently ranked in the Top Decile for the five year period for all 29 out of 29 observations reflecting well on the consistency of our performance.

|

Table 7: Comparison with PMS Multicap Universe as of 31st July 2023 |

||||

|

Fund or Category / Returns Generated 1 2 |

1 year (%) |

2 year (%) |

3 year (%) |

5 year (%) |

|

Sameeksha PMS |

35.49 |

15.93 |

34.5 |

26.2 |

|

Multicap Universe Average |

21.2 |

11.2 |

26.8 |

14.1 |

|

Decile Rank within the Multicap Universe |

Top Decile |

9th Decile |

9th Decile |

Top Decile |

|

Percentile Rank within the Multicap Universe |

Top 7% |

Top 17% |

Top 12% |

Top 1% |

|

Rank within the Multicap Universe 3 4 5 6 |

6th out of 80 |

14th out of 79 |

9th out of 68 |

1st out of 51 |

1. Post fees and expenses 2. Aggregate Portfolios 3. 80 Funds 4. 79 Funds 5. 68 Funds 6. 51 Funds

Returns of Individual Portfolios

Because we don’t follow model portfolio strategy, the performance of individual clients is far more important than overall portfolio aggregate returns (Table 8). For investors who are with us for 3 years and more, Sameeksha PMS has returned a very substantial alpha with an average annualized alpha of approx. 8.4% for the three year period ending 31st July, 2023. Similarly, for investors who are with us for 5 years or more, Sameeksha PMS has returned substantial alpha with an average annualized alpha of approx. 13% for the five year period ending 31st July, 2023. The table below shows the average annualized returns and alpha over different periods of time of all the clients as on 31st July, 2023.

|

Table 8: Performance of All Client Portfolios across various duration |

|||||||||

|

Median Age of Accounts 2 3 4 |

Since Inception |

Five Years (Benchmark1 Return = 13.5%)2 |

Three Years (Benchmark1 Return = 25.2%) 2 |

Two Years (Benchmark1 Return = 13.0%)2 |

|||||

|

Average Returns 5 |

Average Benchmark Returns1 |

Alpha |

Average Returns 5 |

Alpha |

Average Returns 5 |

Alpha |

Average Returns 5 |

Alpha |

|

|

7 Years |

21.9 |

15.0 |

6.9 |

26.5 |

13.0 |

34.5 |

9.4 |

13.9 |

0.8 |

|

6.5 Years |

19.0 |

14.6 |

4.4 |

25.0 |

11.5 |

32.2 |

7.0 |

11.7 |

-1.4 |

|

6 Years |

20.6 |

13.7 |

6.9 |

26.5 |

13.0 |

34.8 |

9.7 |

14.9 |

1.9 |

|

5.5 Years |

22.2 |

13.5 |

8.6 |

26.2 |

12.7 |

32.6 |

7.5 |

15.0 |

2.0 |

|

5 Years |

28.3 |

14.3 |

13.9 |

27.6 |

14.1 |

35.9 |

10.8 |

17.0 |

4.0 |

|

4.5 Years |

27.5 |

16.4 |

11.0 |

– |

– |

32.0 |

6.8 |

16.3 |

3.3 |

|

4 Years |

27.5 |

16.1 |

11.4 |

– |

– |

32.5 |

7.3 |

12.7 |

-0.3 |

|

3.5 Years |

30.9 |

18.2 |

12.7 |

– |

– |

32.4 |

7.3 |

14.1 |

1.1 |

|

3 Years |

32.7 |

25.5 |

7.2 |

– |

– |

34.6 |

9.4 |

16.3 |

3.3 |

|

2.5 Years |

24.9 |

18.3 |

6.7 |

– |

– |

– |

– |

15.8 |

2.8 |

|

2 Years |

15.0 |

11.0 |

4.0 |

– |

– |

– |

– |

15.7 |

2.7 |

|

1.5 Years |

22.4 |

10.7 |

11.7 |

– |

– |

– |

– |

– |

– |

|

1 Year |

31.9 |

18.6 |

13.2 |

– |

– |

– |

– |

– |

– |

|

6 Months |

21.3 |

14.2 |

7.0 |

– |

– |

– |

– |

– |

– |

1.S&P BSE 500 TRI 2. As on 31st July 2023 3. Age of Accounts rounded towards the nearest half year 4. Average rounded to the nearest decimal place. 5.TWRR Post fees and expenses.

Performance Of PMS Over The Covid Timeline (Pre, During, And Post)

The Covid Pandemic induced significant volatility in the equity markets. Hence, it is useful to look at the performance across three time slices : Pre Covid, During Covid and Post Covid. Sameeksha PMS has outperformed the benchmark across all of these three time periods with meaningful alpha (Table 9). This consistency of performance may be an important factor in comparing us with the other funds.

|

Table 9: Absolute and Annualised returns1 – Pre, During, and Post Covid |

||||||

|

Duration |

Absolute Portfolio Returns(%) (A) |

Absolute BSE500TRI Returns (%) (B) |

Alpha % (A-B) |

Annualised Portfolio Returns (%) (C) |

Annualised BSE500TRI Returns (%) (D) |

Alpha % (C-D) |

|

01.04.2016 to 29.02.2020 (Pre Covid) |

67.6 |

50.6 |

17.0 |

14.1 |

11.0 |

3.1 |

|

01.03.2020 to 30.06.2022 (During Covid) |

76.0 |

50.4 |

25.6 |

27.5 |

19.1 |

8.3 |

|

01.07.2022 to 31.07.2023 (Post Covid) |

44.2 |

28.8 |

15.5 |

40.2 |

26.3 |

13.9 |

1. Post fees and expenses

Aggregate Portfolio Performance on a financial year and calendar year basis

For the month of July, Sameeksha PMS has outperformed the benchmark BSE 500 TRI by generating 8.3% returns against the benchmark BSE500TRI returns of 3.9%. Looking at our performance over the financial years (Table 10), we have outperformed our benchmark in six out of eight financial years (including the current incomplete financial year). Key however is that the sum of outperformance of 60% in those six years far exceeds the sum of underperformance of 10% in the remaining two years. Furthermore, if we are able to sustain the outperformance achieved so far in this financial year for the rest of the year, it will become a streak of five consecutive years of generating alpha.

|

Table 10: Absolute and relative performance (Financial Year) |

|||

|

Year ended |

% Performance |

||

|

Portfolio (A) 1 2 |

S&P BSE 500 TRI (B) |

Alpha vs S&P BSE 500 TRI (A-B) |

|

|

31.03.2024 3 |

27.2 |

17.6 |

9.5 |

|

31.03.2023 |

4.5 |

(0.9) |

5.4 |

|

31.03.2022 |

23.4 |

22.3 |

1.1 |

|

31.03.2021 |

106.3 |

78.6 |

27.7 |

|

31.03.2020 |

(13.0) |

(26.5) |

13.5 |

|

31.03.2019 |

1.4 |

9.7 |

(8.3) |

|

31.03.2018 |

11.7 |

13.2 |

(1.5) |

|

31.03.2017 |

28.7 |

25.5 |

3.2 |

1. Post Fees and Expenses, 2. Aggregate Portfolio 3. As of 31st July 2023

For the calendar year 2023 till date, we have positioned ourselves well by outperforming the benchmark BSE500 TRI by 14.7%. However, for the completed calendar year 2022, we have underperformed the benchmark BSE500 TRI by 6.8% (Table 11). This can be mainly attributed to the onset of the Ukraine-Russia war at the start of the calendar year and the ensuing global economic crisis. Nonetheless, we have taken corrective actions since then and we hope to have a good calendar year 2023. However, we have outperformed the benchmark in five out of eight calendar years and the sum of outperformance of 70% in five years far exceeds the sum of underperformance of 16.5% in the remaining three years.

|

Table 11: Absolute and relative performance (Calendar Year) |

|||

|

Year ended |

% Performance |

||

|

Portfolio 1 2 |

BSE 500 TRI |

Alpha vs S&P BSE 500 TRI (A-B) |

|

|

31.12.2023 3 |

25.7 |

11.0 |

14.7 |

|

31.12.2022 |

(2.0) |

4.8 |

-6.8 |

|

31.12.2021 |

48.2 |

31.6 |

16.6 |

|

31.12.2020 |

45.2 |

18.4 |

26.8 |

|

31.12.2019 |

19.8 |

9.0 |

10.8 |

|

31.12.2018 |

(9.9) |

(1.8) |

-8.1 |

|

31.12.2017 |

36.0 |

37.6 |

-1.6 |

|

31.12.2016 |

10.0 |

9.4 |

0.6 |

1. Post Fees and Expenses, 2. Aggregate Portfolio 3. As of 31st July 2023

It is important to note that we delivered this alpha despite maintaining an average cash level of 13.2% across the eight financial years.

Cumulative Performance versus the benchmark

Sameeksha PMS’s outperformance over its benchmark has continued to widen positively over the years. An investment of Rs. 100 with us since inception (April 2016) would have grown to Rs. 428, far outpacing what one would have earned by investing in a fund that achieved benchmark returns (Figure 1).

Analyzing the sector performance during the month

During the month, Sectors that showed growth include Healthcare, Bank and Finance. For Sameeksha PMS, Diamond & Jewellery, Aviation and Healthcare sectors were major outperformers compared to the benchmark. However, due to our lack of exposure towards Power and Infrastructure we missed out on participating in the upturn. Below is the attribution analysis for the month of July 2023 (Table 12).

|

Table 12: Sector Wise Attribution Analysis for the month ending July 2023 |

|||

|

Sector |

Portfolio Contribution |

Benchmark Contribution1 |

Difference |

|

Diamond & Jewellery |

0.80% |

-0.01% |

0.81% |

|

Aviation |

0.60% |

0.00% |

0.60% |

|

Healthcare |

0.91% |

0.37% |

0.54% |

|

IT |

0.54% |

0.18% |

0.36% |

|

Retailing |

0.25% |

0.00% |

0.25% |

|

Electricals |

0.26% |

0.06% |

0.20% |

|

Trading |

0.21% |

0.04% |

0.17% |

|

Finance |

0.79% |

0.67% |

0.12% |

|

Hospitality |

0.12% |

0.01% |

0.11% |

|

Chemicals |

-0.04% |

-0.07% |

0.03% |

|

Textile |

0.02% |

0.01% |

0.01% |

|

Miscellaneous |

0.00% |

0.00% |

0.00% |

|

Ratings |

0.00% |

0.00% |

0.00% |

|

Paper |

0.00% |

0.00% |

0.00% |

|

Abrasives |

0.00% |

0.00% |

0.00% |

|

Insurance |

0.00% |

0.00% |

0.00% |

|

Consumer Durables |

0.00% |

0.01% |

-0.01% |

|

Agri |

0.00% |

0.01% |

-0.01% |

|

Mining |

0.00% |

0.01% |

-0.01% |

|

Ship Building |

0.00% |

0.01% |

-0.01% |

|

Gas Transmission |

0.00% |

0.01% |

-0.01% |

|

Plastic Products |

-0.01% |

0.02% |

-0.03% |

|

Realty |

0.04% |

0.08% |

-0.04% |

|

Construction Materials |

0.00% |

0.04% |

-0.04% |

|

Alcohol |

0.00% |

0.04% |

-0.04% |

|

Diversified |

0.00% |

0.04% |

-0.04% |

|

Logistics |

0.00% |

0.04% |

-0.04% |

|

Telecom |

0.00% |

0.06% |

-0.06% |

|

Capital Goods |

0.07% |

0.14% |

-0.07% |

|

Non – Ferrous Metals |

0.00% |

0.09% |

-0.09% |

|

Media & Entertainment |

-0.02% |

0.08% |

-0.10% |

|

Crude Oil |

0.00% |

0.10% |

-0.10% |

|

Inds. Gases & Fuels |

-0.06% |

0.05% |

-0.11% |

|

Automobile & Ancillaries |

0.12% |

0.24% |

-0.12% |

|

FMCG |

0.00% |

0.12% |

-0.12% |

|

Bank |

0.29% |

0.44% |

-0.15% |

|

Iron & Steel |

0.00% |

0.22% |

-0.22% |

|

Infrastructure |

0.00% |

0.24% |

-0.24% |

|

Power |

0.00% |

0.33% |

-0.33% |

1. BSE500TRI

AIF Performance and other details

Aggregate Fund Returns over various time periods

Since inception, we have maintained relatively higher levels of cash (23.2% on average over the entire period from inception) from time to time over the duration of managing the fund. Notwithstanding the same, from inception and over one year, we have generated returns of 21.4% and 32.1% beating the benchmark BSE500 TRI returns of 10.1% and 17.4% respectively after fees before taxes. (Table 13).

|

Table 13: Fund performance2 in different periods since inception |

|||

|

Particulars |

Portfolio 3 % |

S&P BSE 500 TRI% |

Average Cash level% |

|

Since inception 1 |

21.4 |

10.1 |

23.2 |

|

1 year |

32.1 |

17.4 |

10.8 |

|

6 months |

24.4 |

14.8 |

4.2 |

|

3 months |

18.9 |

12.5 |

1.4 |

|

1 month |

8.3 |

3.9 |

0.4 |

1. Since Inception ie. 11/02/2022 to 31/07/2023 2. Post fees Pre Tax 3. Aggregate Portfolio

Aggregate Fund Performance on a financial year and calendar year basis

For the month of July, Sameeksha AIF has outperformed the benchmark BSE 500 TRI by generating 8.3% returns (including the current incomplete financial year) against the benchmark BSE500TRI returns of 3.9%. Looking at our performance over the financial years (Table 14), we have outperformed our benchmark in FY 2023 and we continue to outperform in the current FY 2024. For the financial year 2024 till date, we have positioned ourselves well by outperforming the benchmark BSE500 TRI by 7.0%.

|

Table 14: Financial year wise fund performance2 since inception1 |

|||

|

Particulars |

Portfolio 3 % |

S&P BSE 500 TRI % |

Alpha vs S&P BSE 500 TRI |

|

FY242 |

24.7 |

17.6 |

7.0 |

|

FY23 |

5.4 |

-0.9 |

6.3 |

1. Since inception i.e from 10/02/2022 to 31/07/2023 2. Post Fees Pre Tax 3. As on 31/07/2023

For the calendar year 2023 till date, we have positioned ourselves well by outperforming the benchmark BSE500 TRI by 13.8%. Despite being a new fund, we were still able to produce alpha for calendar year 2022 and outperformed the benchmark BSE500 TRI by 3.6%. (Table 15)

|

Table 15: Calendar year wise fund performance2 since inception1 |

|||

|

Particulars |

Portfolio 3 % |

S&P BSE 500 TRI % |

Alpha vs S&P BSE 500 TRI |

|

CY232 |

24.8 |

11.0 |

13.8 |

|

CY22 |

7.4 |

3.8 |

3.6 |

1. Since inception i.e from 10/02/2022 to 31/07/2023 2. Post Fees Pre Tax 3. As on 31/07/2023

Risk Adjusted Ratios

When compared on a risk-adjusted basis, our AIF shows an even stronger performance with a risk-adjusted alpha generation of 12.1% over the broader market benchmark since its inception. While our portfolio beta has been materially lower than our benchmark, our returns have been higher than the benchmark implying superior strong risk adjusted returns.

Furthermore, other risk-adjusted returns – Sharpe ratio and Treynor ratio, are also significantly higher than the benchmark indices (Table 16).

|

Table 16 : Risk Adjusted ratios 1 |

||

|

Particulars |

Portfolio |

S&P BSE 500 TRI |

|

Jensen’s Alpha (x) |

12.1 |

0.0 |

|

CAPM Beta (x) |

0.6 |

1.0 |

|

Sharpe Ratio (x) |

1.7 |

0.7 |

|

R-Squared (%) |

68 |

100 |

|

Treynor (x) |

31.2 |

10.6 |

1. Since inception i.e from 10/02/2022 to 31/07/2023

Performance within the AIF Universe

We present our rankings among Long Only Category III AIFs who report their post expense and pre tax returns. For the period ending 30th June, 2023, we are ranked 5th out of 25 AIFs (Table 17). We are ranked in the 9th Decile among 25 funds in the said category.

|

Table 17 :Comparison of Sameeksha AIF with Long Only AIFs (post exp pre tax returns) |

|

|

Returns Generated |

1 year |

|

Sameeksha AIF |

32.1% |

|

Average |

25.7% |

|

Median |

25.7% |

|

Median Among Top 5 AIFs |

37.2% |

|

Sameeksha AIF Rank within the Multicap Category |

5th out of 25 |

|

Sameeksha AIF Decile1 Rank within the Universe |

9th Decile |

|

Sameeksha AIF Percentile Rank |

Top 19% |

1. 9th Decile = in top 10%, outperformed 90% of the funds

Cumulative Performance versus the benchmark

Sameeksha AIF’s outperformance over its benchmark has continued to widen positively since inception. An investment of Rs. 100 with us since inception (Feb 10,2022) would have grown to Rs. 133, far outpacing what one would have earned by investing in a fund that achieved benchmark returns (Figure 2).

Analyzing the sector performance during the month

During the month, indices that showed growth this month include Finance, Automobile & Ancillaries, and Healthcare. For Sameeksha AIF, the Electricals, Retailing, Healthcare and Finance were major outperformers compared to the benchmark. However, what hurt us is the lack of exposure towards the Automobile & Ancillaries sector where we missed out on participating in the upturn. Below is the attribution analysis for the month of July 2023 (Table 18).

|

Table 18: Sector Wise Attribution Analysis for the month of July 2023 |

|||

|

Sector |

Portfolio Contribution |

Benchmark1 Contribution |

Difference |

|

Electricals |

0.72% |

0.02% |

0.70% |

|

Retailing |

0.75% |

0.10% |

0.65% |

|

Healthcare |

1.06% |

0.43% |

0.63% |

|

Finance |

1.34% |

0.71% |

0.63% |

|

Diamond & Jewellery |

0.52% |

0.08% |

0.44% |

|

Bank |

0.67% |

0.28% |

0.39% |

|

Media & Entertainment |

0.34% |

-0.02% |

0.36% |

|

Textile |

0.30% |

0.02% |

0.28% |

|

Logistics |

0.26% |

0.01% |

0.25% |

|

Realty |

0.29% |

0.07% |

0.22% |

|

Chemicals |

0.29% |

0.09% |

0.20% |

|

Hospitality |

0.18% |

0.00% |

0.18% |

|

FMCG |

0.31% |

0.16% |

0.15% |

|

Capital Goods |

0.24% |

0.14% |

0.10% |

|

Trading |

0.02% |

-0.03% |

0.05% |

|

Gas Transmission |

0.00% |

-0.02% |

0.02% |

|

Mining |

0.00% |

-0.02% |

0.02% |

|

Paper |

0.00% |

0.00% |

0.00% |

|

Ratings |

0.00% |

0.00% |

0.00% |

|

Abrasives |

0.00% |

0.01% |

-0.01% |

|

Miscellaneous |

0.00% |

0.01% |

-0.01% |

|

Alcohol |

0.00% |

0.01% |

-0.01% |

|

Ship Building |

0.00% |

0.01% |

-0.01% |

|

Diversified |

0.00% |

0.01% |

-0.01% |

|

Non – Ferrous Metals |

0.00% |

0.02% |

-0.02% |

|

Consumer Durables |

0.00% |

0.03% |

-0.03% |

|

Agri |

0.00% |

0.03% |

-0.03% |

|

Plastic Products |

0.00% |

0.04% |

-0.04% |

|

Construction Materials |

0.00% |

0.05% |

-0.05% |

|

Inds. Gases & Fuels |

-0.08% |

0.00% |

-0.08% |

|

Aviation |

-0.07% |

0.02% |

-0.09% |

|

Telecom |

0.00% |

0.10% |

-0.10% |

|

Power |

0.00% |

0.11% |

-0.11% |

|

Insurance |

0.00% |

0.14% |

-0.14% |

|

IT |

0.03% |

0.17% |

-0.14% |

|

Iron & Steel |

0.00% |

0.21% |

-0.21% |

|

Crude Oil |

0.00% |

0.24% |

-0.24% |

|

Automobile & Ancillaries |

0.19% |

0.44% |

-0.25% |

|

Infrastructure |

0.00% |

0.30% |

-0.30% |

1. BSE500TRI

Disclaimer – The information contained in this update is provided by our fund accounting platform and is not audited.